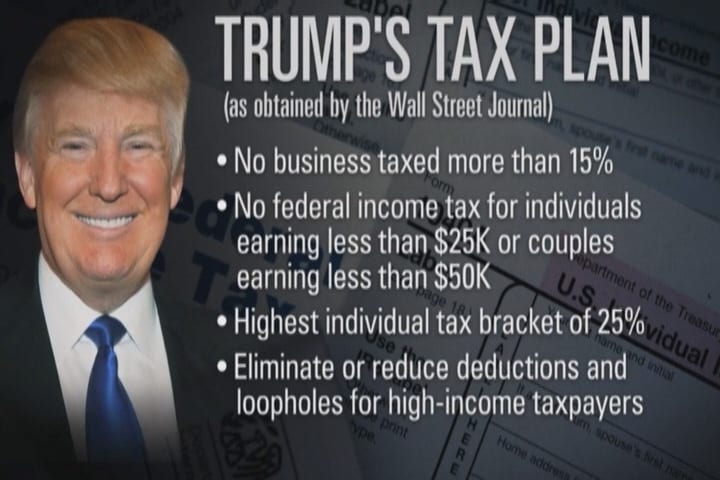

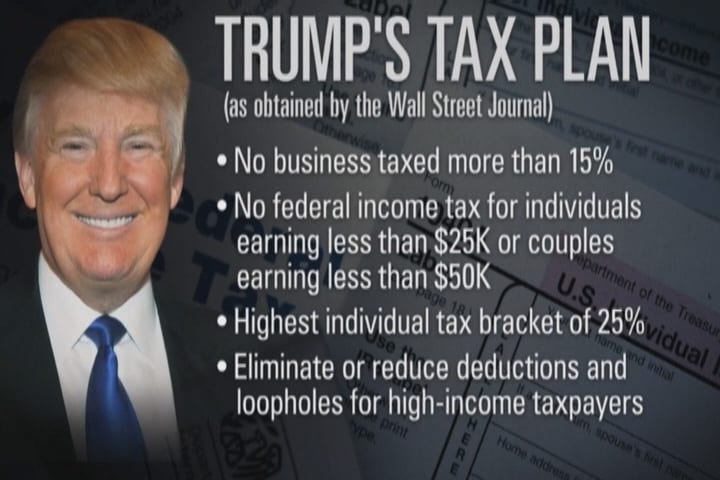

According to news filtering out from Washington DC, President Trump plans to cut the corporate tax rate from 35% to 15% in order “to make the United States more competitive.”

The White House says the United States has one of the highest corporate tax rates in the world, but the truth is that after corporate deductions and tax credits, the typical American corporation pays an effective tax rate of 27.9 percent, only a bit higher than the average of 27.7 percent among other advanced nations.

The Congress Joint Committee on Taxation says this reduction will reduce federal revenue by $2 trillion over 10 years. Imagine that magnitude of reduction in federal revenue and what the consequences will be for our economy. It will surely require huge cuts in programs for the poor, and, or additional tax revenues from the rest of us to make up for it.

Of course, the White House’s explanation is that the tax cuts will create a jump in economic growth that will generate enough new revenue to wipe out any increase in the budget deficit. The truth, however is that nobody, or study has been able to prove that tax cuts actually generate economic growth. The two major tax cutting presidents, Reagan and G.W Bush both ended their terms with huge budget deficits, while Bill Clinton who raised taxes, only marginally, had the economy create more jobs than either under Reagan or Bush.

This is purely nothing but just another give away to America’s corporations and the rich that will further expand the economic divide.

Another give away the Trump administration has planned for American corporations and their owners is the administration’s plan to allow them repatriate the $2.6 trillion dollars they’ve been holding in offshore accounts because they didn’t want to pay taxes on the funds.

President Trump is planning to allow them pay just 10% taxes on the funds to bring them home. Watchers say this plan might help the president and his tax reform through Congress because both Republicans and Democrats have been wanting to do a deal on repatriation since during the Obama presidency. Republicans might be interested in using the money raised to finance the tax cuts for corporations and the rich, while Democrats would want the money raised to be used to rebuild infrastructure.

How those two separate expectations for how to use the repatriated money is squared out in Congress might determine whether the president gets a go ahead on his plan, or not.