This process is crucial for maintaining accurate financial records and ensuring that there are no discrepancies in the company’s books. It entails reviewing each transaction, comparing it with the corresponding bank statement entry, and making any necessary adjustments to ensure the accuracy of the records. During the reconciliation process, you will compare the transactions listed on your bank statement to the ones recorded in QuickBooks Online to ensure they match. This includes comparing deposits, withdrawals, checks, and any other transactions. The goal is to identify any discrepancies or missing transactions that may occur due to timing differences or errors in data entry.

How to reconcile an account in QuickBooks Online

This validation step is pivotal in maintaining the integrity and accuracy of financial records, enabling businesses to confidently rely on their financial reports for decision-making and compliance purposes. Are you looking to master the art of reconciliation in QuickBooks? Whether you’re using QuickBooks Online or QuickBooks Desktop, understanding the process of reconciliation is crucial for ensuring the accuracy and integrity of your financial records.

Best Accounting Software for Small Businesses of 2024

When you know how to reconcile in QuickBooks, you can use the software to double-check that all of your financial records are in order. This way, you can use the digital tools at your disposal to augment, not completely replace, your accounting function. Note that these instructions apply to users with QuickBooks Online.

Review the reconciliation adjustment

Enter the correct information based on your credit card statement. If you aren’t a QuickBooks Desktop user yet, you can choose from a types of endorsements flashcards Pro, Premier, Enterprise, or Accountant package. We compare QuickBooks Desktop products to help you decide which one is right for you.

It plays a crucial role in ensuring the financial accuracy and integrity of a company’s records. By reconciling regularly, businesses can detect and rectify any discrepancies, minimizing the risk of errors and fraudulent activities. This process directly impacts the balance sheet accounts, transactions, and banking activities.

- Making necessary adjustments in QuickBooks Online brings your financial records in line with the information on your bank statement.

- In accounting, reconciliation is the process of matching transactions you’ve entered into your accounting software with the information on statements from outside sources, usually financial institutions.

- If you choose the free trial, note that QuickBooks requires a credit card to sign up.

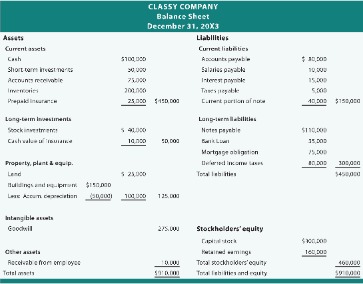

- Here’s a sample reconciliation with all of the transactions matched to a credit card statement.

- To carry out a reconciliation, you will need to have your monthly bank or credit card statements on hand.

- QuickBooks will load the statements and facilitate a side-by-side comparison.

Make sure you enter all transactions for the bank statement period you plan to reconcile. If there are transactions that haven’t cleared your bank yet and aren’t on your statement, wait to enter them. QuickBooks Online Essentials costs an additional $25 per month, which adds features like bill management and time tracking. Unlike QuickBooks Simple Start, which includes access for one user and their accountant, Essentials allows you to add up to three users (plus your accountant).

This finalization stage is vital for ensuring the accuracy and integrity of the financial data, providing a clear overview of the company’s financial position and allowing for informed decision-making. If you need to make changes after you reconcile, start by reviewing a previous reconciliation report. If you reconciled a transaction by https://www.quickbooks-payroll.org/ accident, here’s how to unreconcile individual transactions. In stark contrast to QuickBooks Online, each Xero accounting plan includes basic inventory management and an unlimited number of users. Xero’s software is easily as user friendly as QuickBooks’ with a colorful, organized dashboard and highly reviewed apps for iOS and Android.

Even small business accountants appreciate the automated reconciliation feature in QuickBooks Online that can have your accounts reconciled in minutes, not hours. When you reconcile, you compare two related accounts make sure everything is accurate and matches. Just like balancing your checkbook, you need to do this review in QuickBooks. You should reconcile your bank and credit card accounts in QuickBooks frequently to make sure they match your real-life bank accounts. Making necessary adjustments in QuickBooks Online brings your financial records in line with the information on your bank statement.

You can also reconcile various asset and liability accounts using the reconciliation feature. While it reduces the amount of time you need to expend working on reconciling your accounts, the odds of your bank statement and your general ledger matching immediately is pretty slim. It’s not that there aren’t advantages to connecting your bank account to your software, but it doesn’t do all the work for you. The only time the two will likely match is if there’s no activity on the account. Navigate to the Reconcile tab under Accounting, select the appropriate credit card account, and enter the statement date and ending balance from your credit card statement.

You can then select Start reconciling to begin the reconciliation of each transaction in that account. Finally, you need to make sure all transactions are matched to already-entered transactions, or categorized and added if there is no such transaction entered already. QuickBooks will attempt to match downloaded transactions to previously-entered transactions to avoid duplication. However, businesses with high transaction volumes might benefit from more frequent reconciliations. Below, we delve into a detailed explanation of the account reconciliation process within QuickBooks. If the difference is not zero, we recommend that you try to locate transactions that aren’t recorded in QuickBooks.

It will teach you how to review, classify, and accept or exclude transactions that are imported automatically from your connected credit card accounts. If this is the first time you’re reconciling this account, the beginning balance in QuickBooks will be zero. Make sure you’re using the very first bank statement https://www.business-accounting.net/what-does-vertical-analysis-of-a-balance-sheet/ for that account. You may have to go back many months and then move forward, reconciling one month at a time. If it’s impossible to start your reconciliation in the first month of the bank account, you might need an experienced bookkeeper to help with your first reconciliation to get you on track.

While the most likely cause is an error in your QuickBooks accounting, don’t delete the transaction because it may affect other accounts or periods. Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly. Although it’s relatively easy to undo reconciliation in QuickBooks Online, doing so should be a rare exception rather than something you do as a regular part of your bookkeeping process. Reconciling your accounts is an important step in your business accounting process.